Content

May I get the debit memo with out registering your account? SignNow gives the debit memo for almost any consumer who gets a unique ask from signNow, even when they never have got a signNow account. As soon as you full all of your allocated career fields, click on Done and replicates of your document will probably be sent to equally you and the document’s article writer. A transaction that reduces Amounts Receivable from a customer is a credit memo. A debit memo is a transaction that reduces Amounts Payable to a vendor because; you send damaged goods back to your vendor. If a customer overpays an invoice or an error happened leading to paying more than the required payment.

Debit memos frequently include revisions or modifications to previous transactions. To request a reduction in the amount owed to a seller, such as when returning faulty goods, the buyer issues a debit memo and debits Accounts Payable. A debit note is a commercial seller’s, buyer’s, or financial institution’s notification of a debit placed on a recipient’s account in the sender’s books. In many cases, debit memos get issued due to damaged or incorrect goods or a purchase cancellation, for example. A seller may issue a credit memo to a buyer for a variety of reasons. The buyer returning a purchased item to the seller is a common motive.

What are the types and uses of Debit memorandums?

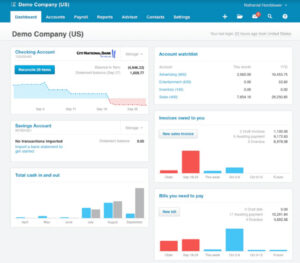

It can be used to send out contracts for signing even though users do not have signNow accounts. Notification Bots keep customers updated on document status changes. The signNow app is debit memo withdrawal a perfect solution to debit memo quickly, securely and effortlessly. Memo-posting is a term used in traditional computerized banking environments where batch processing is employed.

What is a debit memo?

Debit memos, also called debit notes, are corrections to invoices. If you accidentally submit an invoice that's too low, you can send a debit memo to correct it and increase the invoice after it's sent. The customer can then use the memo to adjust their books, as well.

Quickly set up a signing order and add dual-factor authentication to get a debit memo. Track the whole process from start to finish and see all actions taken to your forms and contracts with the Audit Trail feature. Even though physical goods are changing hands, money is not, because the buyer is not required to pay until an invoice is issued, as per the payment and credit terms agreed between the seller and the buyer. A buyer makes a new order on credit, increasing the total amount owed to a seller for unpaid credit orders made so far, which will need to be settled when the seller issues an invoice at a later date. Buyer issues a debit memo and debits Accounts Payable to request a reduction in an amount due to a seller, for example when returning faulty goods.

What is Credit Memo?

A digital signature is no longer the future, but the present. Contemporary businesses with their turnover simply cannot afford to stop web-based platforms that provide superior document processing automation tools, including Bpi debit memo option. Ensure that you add extra protection to your force pay debit memo.

- A bank might utilize a debit memo to reduce an account’s balance.

- In the case of a cash sale, it denotes the amount of benefit provided to the client by the supplier.

- SignNow gives the debit memo for almost any consumer who gets a unique ask from signNow, even when they never have got a signNow account.

- A force pay debit memo is a classification for recording a specific type of debit transaction.

Use the full-featured solution to generate an eSignature and reuse it in the future for document verification. Bpi what is force pay bpi debit memo issue in bpi fast and conveniently. Google Chrome features multiple advantages that users can’t ignore, making it the top browser across the US. For instance, it’s the number one browser for its speed and library of extensions. With Chrome you can synchronize bookmarks, history and settings across all of your devices. To sign a document in Google Chrome, search for the signNow add-on in the Web Store and download it.

What is a Debit Memo? Types, Uses, and Definition

In the meantime, the seller sends a debit note to the buyer with each delivery, as well as a periodic statement of total outstanding amounts payable. A debit memo can be used to reverse an overcharged customer’s payment. This enables the accounting division to resolve it by returning the memo to the client. A debit memo is used to denote an adjustment to a customer’s account that reduces their balance. A debit memorandum is a notification to a customer that a debit adjustment has been made to their account, reducing the value of funds available.

Hashaw holds an MBA in Real Estate and an MSci in Project Management. She is further certified in organizational change management, diversity management, and cross-cultural mediation. Merchants are monitored by payment processors for their chargeback ratio. This ratio can indicate levels of risk for fraud or poor business conduct.

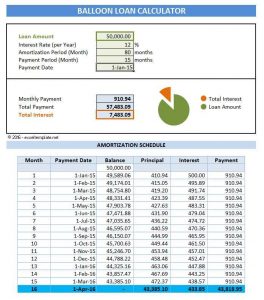

When incrementally raising an amount previously invoiced because of a typographical error or a price change, the seller issues a debit memo and debits accounts receivable. The supplier would add a $150 debit memo to their accounts receivable while the customer would add the extra $150 to their accounts payable. When this happens, the fees work as more of an adjustment instead of a specific transaction. Then, it gets debited from your account and is then recorded as a debit memo. In some cases, debit memos can get used to help rectify inaccurate account balances.

- Therefore, each transaction on the bank statement should be double‐checked.

- Open an email with an attachment that you need to share for signing and click signNow.

- The memo will also determine how a financial institution treats the debit.

- Seller issues a debit memo and debits Accounts Receivable to increase a buyer’s debt obligations, for example when incrementally increasing a previously invoiced amount due to a clerical error or price change.

- Companies may authorize a bank to automatically transfer funds into or out of their account.

In order for him to access the electronic credit for which he is eligible, the bank creates a temporary “memo” credit to increase the balance available . Later, this entry will be removed as part of the EOD batch process. Memo Posted Debits.Any debits being posted to the account for business day.

Who issues a debit memo?

A bank creates a debit memo when it charges a company a fee on its bank statement, thereby reducing the balance in the company's checking account.

No products in the cart.

No products in the cart.